LendIt Fintech Industry Awards Finalist

We are thrilled to announce that we have been named a Finalist for the Most Promising Partnership Award at the LendIt Fintech Industry Awards, along with BMO Harris Bank for our partnership. The LendIt Fintech conference is the world’s leading event in financial services innovation, and the awards bring together 400 Fintech influencers and innovators to celebrate outstanding achievements. We can’t wait to attend.

We greatly value our partnership with BMO Harris Bank and the work we are doing together to increase financial wellness opportunities Our partnership began in 2017 when we were selected to participate in the BMO Harris/1871 Fintech Partnership Program, were then selected as one of the winners, and ultimately launched an official partnership in August of 2018. Since that time, we continue to make great strides working together to improve the financial lives of BMO Harris customers.

Let us know if you will be at the LendIt conference on April 8th & 9th as we welcome the opportunity to meet with you.

Rochelle Nawrocki Gorey

Co-Founder & CEO, SpringFour Inc.

Awards and Recognition

DRIVE IMPACT WITH US

FOLLOW US

JOIN OUR MAILING LIST

Defaulting Auto Loans: The Next Big American Crisis

Millions of Americans are on the brink of losing their cars in 2019, and this may very well be a catalyst pushing us all toward the next big American crisis.

Car ownership is essential and more and more individuals and families continue to purchase automobiles in order to provide them with the transportation needed to sustain daily life. And, although automotive technology has changed drastically over the years, one thing remains the same – most cars are purchased by leveraging a loan. In fact, as noted in a Feb 12th, 2019 Washington Post article, 2016 marked a record high with 17.5 million vehicles sold in the United States. Also, according to CNN (in a Feb 13th, 2019 article), there were about 89 million auto loans in the U.S. market in the 4th quarter of this past year.

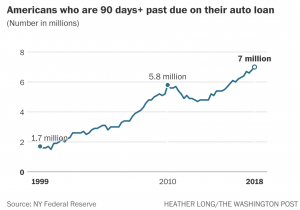

What is most striking, however, is not the number of auto loans that are being generated, but the number of auto loans that are falling past due. And, not just past due, but at least 3 payments past due! In fact, the Federal Reserve Bank of New York reported this

Unless you yourself are facing the daunting challenge of trying to dig out of a deep auto loan delinquency situation, most people don’t realize how quickly you can lose your vehicle. What is gravely concerning about the noted 7 million auto loans that are 90 days or more behind on their payments, is that all of the vehicles tied to these loans are targets for repossession. Losing your vehicle is painful in itself, but then having to deal with the aftermath, that’s where the countless challenges emerge. For, many of us rely on our car to get us to work, to take our kids to school, to pick up groceries, and make critical appointments. Without your car, life really does stop and one can get paralyzed by this loss.

The trouble we are witnessing with auto loan repayment is a crisis indeed, and it is a crisis that is creeping up on all of us. This crisis is something that is not isolated to any one age group (see below figure published in a Feb 18th, 2019 Yahoo Finance article). As illustrated, all charted age groups show a rise in auto loan delinquency trends, but what is extra alarming is the extreme rise of delinquency in the millennial age groups (our largest age group of Americans). This points to an even stronger and more concerning correlation to auto loans and other

Many experts believe that this crisis is a sign of something much more severe coming down the road for our overall economy, as auto loans tend to be one of the first loans people think about

Our SpringFour team has mentioned in previous blogs that although the U.S. economy is doing well, many millions of Americans still are struggling with their finances. At SpringFour, we understand the need to supply these individuals with truly impactful local non-profit and government resources that can assist them in digging out of the deep holes in which they find themselves trapped. Through key partnerships that SpringFour has made with banks and lenders, there is hope for these financially-burdened individuals. And, this hope extends to the auto loan crisis.

To learn more about SpringFour and how we are partnering with financial institutions to address financial wellness and help individuals and families avoid crippling situations like auto loan defaults, please visit our website (springfour.com).

Scott Freeze

Chief Operating Officer, SpringFour Inc.

Awards and Recognition

DRIVE IMPACT WITH US

FOLLOW US

JOIN OUR MAILING LIST

Announcing the FinXTech Connect Platform Launch!

We all understand how difficult it can be to find the right solution, with the right technology to enhance services. Particularly in the banking industry it can be especially difficult to know if a technology company has the wherewithal to withstand vendor on-boarding and to find partnerships whose outcome has proven results. That’s why we were excited about the launch of Bank Director’s new FinXTech Connect platform, and to be included as one of the select fintech companies in the platform.

Bank Director launched the FinXTech Connect platform in January of this year in an effort to make it easier for U.S. banks to uncover proven technology partners and solutions. The platform is a curated, online directory of technology companies that are strategically partnering with financial institutions. And Bank Director’s team did the hard work of hand-selecting and vetting every technology company and solution, determining which are most “bank-friendly.” All companies selected for the platform must have a proven history of financial performance and an existing roster of bank clients.

SpringFour is proud of our successful history of bank partnerships. We see ourselves as a “partner” rather than a “vendor” and work every day to cultivate a relationship of mutual trust and commitment that insures success.

We look forward to continuing our work and furthering our impact with our existing bank bank partnerships, and in forging new ones. The FinXTech Connect platform provides one more way to showcase technology solutions, and enables us to build on our current and future partnerships.

To learn more about FinXTech, reach out to them here. If you would like to find out more about SpringFour solutions and how they might be helpful to your customer experience and financial wellness efforts, you can give us a call or shoot us an email.

Katie Gottschall Donohue

Vice President, Strategy and Customer Engagement, SpringFour Inc.

Awards and Recognition

DRIVE IMPACT WITH US

FOLLOW US

JOIN OUR MAILING LIST

The Perfect Storm

It has been well-documented that many millions of Americans are struggling to pay their bills and are living paycheck to paycheck. In fact, nearly half of the US can’t afford an unexpected $400 expense. Additionally, the majority of Americans have little to no savings.

Combined with the recent government shutdown, a financial “perfect storm” is brewing for many Americans.

A recent article by Zillow Research (link) stated that unpaid federal workers owe $438 million in mortgage and rent payments in the month of Jan’19. All of this information, coupled with post-holiday debt and upcoming tax bills owed, points to countless consumers looking for ways to reduce expenses and better their financial health situations.

This is where SpringFour excels. We assist people in getting back on track by helping to provide direction to local resources that reduce household expenses.

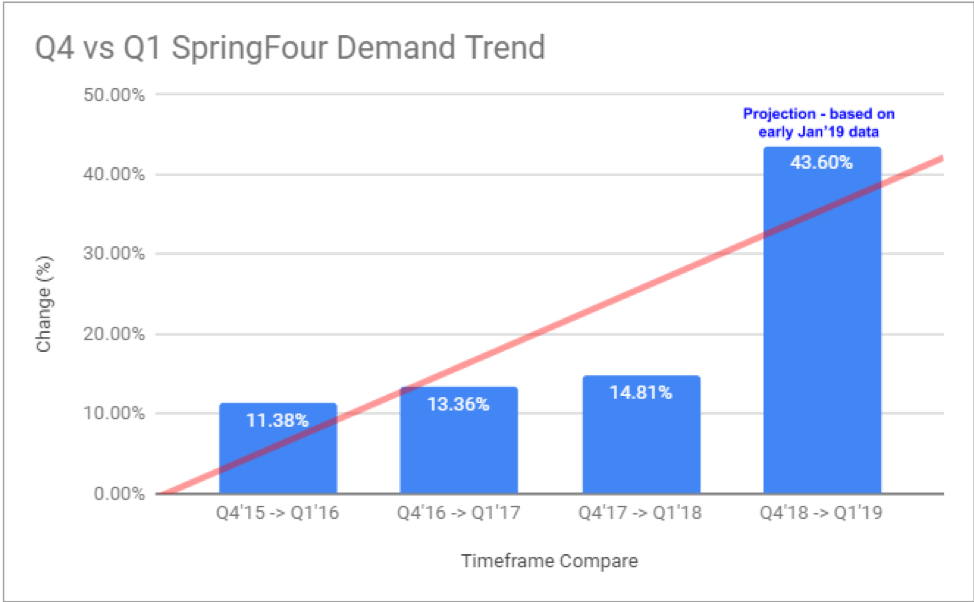

The need for the SpringFour financial health resource platform has traditionally seen its greatest demand during the early months of a new year. Additionally, knowing the effects of the government shutdown, SpringFour is positioned to help considerably more Americans this year than ever before.

Below is an illustration with figures and trends pointing to SpringFour usage increases that have been measured in past post winter holidays. Also included is projected usage based on early data results for Jan’19 (inclusive of elevated need due to the government shutdown).

Across the board, SpringFour subscribers who are wisely and strategically using SpringFour tools are not only seeing tremendous use, but are also delivering great return on their investment and receiving glowing feedback from their customers and their staff.

Below are just a few impact statistics and feedback that subscribers have shared with us as a result of their work with SpringFour:

– Demand is Climbing: noted SpringFour subscriber seeing 400%+ increase in use mth/mth

– Messaging Works: 15k+ referrals made from S4direct after a single subscriber email campaign

– LoanPerformance Improves: customers 10% more likely to remain current on loans

– Level of Engagement Increases: customers 2x more likely to engage in foreclosure prevention efforts

– Consumer Expense Decrease: typical consumers reduce their expenses by $250/mth

– Boost to Brand Image: 42% of customers felt better about their lender

– Employees are Empowered: 94%+ of agents felt SpringFour allowed them to provide better customer service

– Customer Feedback is Positive: Customers calling back their lender to let them know how appreciative they are of the SpringFour referrals. These experiences have led to increased loyalty and have resulted in improved customer positions to pay and stay current

At SpringFour, we believe that providing tangible next steps and direction to resources during extremely stressful times (post-holiday, unplanned income loss / government shutdown, and tax burden situations) is not only the right thing to do, but it is good for business and will certainly boost the image of the company leveraging SpringFour.

Let us know if you are ready to take the next steps to provide your customers with the resources they need to improve their financial health and weather the storm.

Scott Freeze

Chief Operating Officer, SpringFour Inc.

Awards and Recognition

Recent Comments