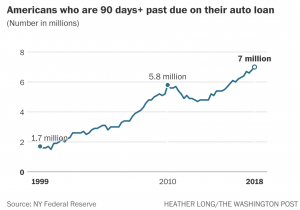

Millions of Americans are on the brink of losing their cars in 2019, and this may very well be a catalyst pushing us all toward the next big American crisis.

Car ownership is essential and more and more individuals and families continue to purchase automobiles in order to provide them with the transportation needed to sustain daily life. And, although automotive technology has changed drastically over the years, one thing remains the same – most cars are purchased by leveraging a loan. In fact, as noted in a Feb 12th, 2019 Washington Post article, 2016 marked a record high with 17.5 million vehicles sold in the United States. Also, according to CNN (in a Feb 13th, 2019 article), there were about 89 million auto loans in the U.S. market in the 4th quarter of this past year.

What is most striking, however, is not the number of auto loans that are being generated, but the number of auto loans that are falling past due. And, not just past due, but at least 3 payments past due! In fact, the Federal Reserve Bank of New York reported this

Unless you yourself are facing the daunting challenge of trying to dig out of a deep auto loan delinquency situation, most people don’t realize how quickly you can lose your vehicle. What is gravely concerning about the noted 7 million auto loans that are 90 days or more behind on their payments, is that all of the vehicles tied to these loans are targets for repossession. Losing your vehicle is painful in itself, but then having to deal with the aftermath, that’s where the countless challenges emerge. For, many of us rely on our car to get us to work, to take our kids to school, to pick up groceries, and make critical appointments. Without your car, life really does stop and one can get paralyzed by this loss.

The trouble we are witnessing with auto loan repayment is a crisis indeed, and it is a crisis that is creeping up on all of us. This crisis is something that is not isolated to any one age group (see below figure published in a Feb 18th, 2019 Yahoo Finance article). As illustrated, all charted age groups show a rise in auto loan delinquency trends, but what is extra alarming is the extreme rise of delinquency in the millennial age groups (our largest age group of Americans). This points to an even stronger and more concerning correlation to auto loans and other

Many experts believe that this crisis is a sign of something much more severe coming down the road for our overall economy, as auto loans tend to be one of the first loans people think about

Our SpringFour team has mentioned in previous blogs that although the U.S. economy is doing well, many millions of Americans still are struggling with their finances. At SpringFour, we understand the need to supply these individuals with truly impactful local non-profit and government resources that can assist them in digging out of the deep holes in which they find themselves trapped. Through key partnerships that SpringFour has made with banks and lenders, there is hope for these financially-burdened individuals. And, this hope extends to the auto loan crisis.

To learn more about SpringFour and how we are partnering with financial institutions to address financial wellness and help individuals and families avoid crippling situations like auto loan defaults, please visit our website (springfour.com).

Scott Freeze

Chief Operating Officer, SpringFour Inc.

Awards and Recognition