Just Released: SpringFour’s Q3 2024 Impact Report

Just Released: SpringFour’s Q3 2024 Impact Report

We are proud to announce the release of SpringFour’s Q3 2024 Impact Report!

The third quarter was like no other because SpringFour was acquired by C&R Software, a CORA Group company and subsidiary of Constellation Software, Inc., the 23rd largest software company in the world with an $80B market cap!

Since 2005, we have connected millions of consumers with financial health resources via the banks, lenders, credit unions, employers, nonprofits, and other organizations that serve them. Most of all, we’ve put the win-win importance of financial health on the map. With this acquisition by C&R Software, we can confidently say that financial health is here to stay.

Read more about our Q3 impact and how SpringFour is delivering much-needed support — when and where it’s needed.

What’s Inside SpringFour’s Q3 Impact Report?

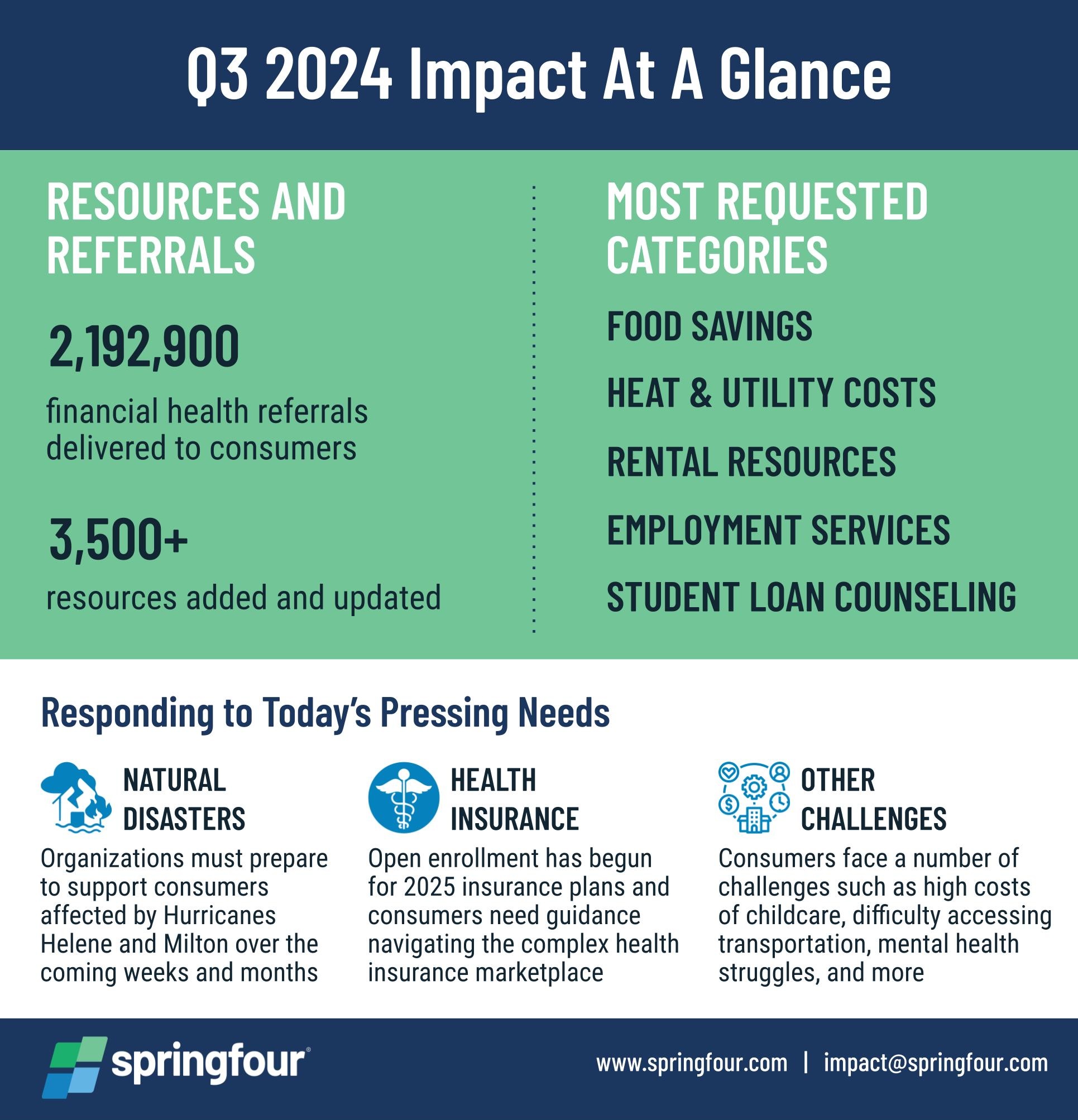

→ Impact metrics at a glance (page 3)

→ C&R Software acquisition details (page 4)

→ Natural disaster response and recovery (page 5)

→ Health insurance resources available for open enrollment (page 6)

→ One year of delivering transportation savings resources (page 7)

→ Supporting military families and accessing affordable childcare (page 8)

→ Self Financial and SpringFour Partnership Overview (page 9)

→ Panel at Financial Wellbeing Symposium and Top Women in Tech Award (page 10)

Why More Companies Are Creating Impact with SpringFour

More and more organizations are working with SpringFour to incorporate financial health into their bottom lines, driving valuable impact for consumers, employees, and organizations alike. We couldn’t be prouder of this work.

As Nicole Casperson wrote in a Fintech Is Femme feature on SpringFour:

More companies are realizing that helping customers manage their finances goes beyond apps and payments — it’s about building trust by providing real, practical help.

We work with some of the biggest names in the industry to deliver financial health referrals to millions of individuals each year. Since day one, we have known this: people need and deserve access to resources that help them find their way out of financial hardship.

Here’s What You Can Do With This Report

→ If you are a current SpringFour client, take a look at the trends in this report to ensure you’re offering the categories that consumers need most right now. Reach out to us at resources@springfour.com to change the categories offered in your SpringFour deployment.

→ If you’d like to learn more about partnering with us, reach out to info@springfour.com to set up an introductory call and product demo.

→ If there’s someone you think would enjoy this report, send them the link or post it on your LinkedIn to share the report with your community. Tag us on LinkedIn at @SpringFour!

Morgan Pierce

Impact & Communications Manager, SpringFour

Awards and Recognition

DRIVE IMPACT WITH US

FOLLOW US

JOIN OUR MAILING LIST

How we support people through natural disasters, healthcare access, home purchases, and more

How we support people through natural disasters, healthcare access, home purchases, and more

With open enrollment coming up on November 1st, the SpringFour team has been hard at work building on our existing government-backed health insurance resources. SpringFour has added non-profits that help individuals with insurance program research and enrollment, including referrals to local, non-profit Health Insurance Navigators that help individuals with insurance program research and enrollment to offer a lifeline to the uninsured.

We’re giving people access to hundreds of vetted, local, statewide, and nationwide programs dedicated to closing the uninsured gap because:

- Healthcare costs are burdensome for half of American adults.

- For seven percent of Americans, the price of insurance alone is so prohibitive that they live uninsured and skip routine healthcare visits.

- Millions of people enroll in health insurance through the Open Marketplace each year; open enrollment can be confusing and people don’t know where to turn. SpringFour’s resources bring clarity and relief to people navigating the complex health insurance marketplace.

- Millions of people who were enrolled in Medicaid during the pandemic have now lost access to that coverage due to ineligibility and need to apply for insurance coverage on the Affordable Care Marketplace.

Our newly-added Health Insurance resources and brand new SpringFour-authored Financial Health Resource Guide offer information and tips for navigating government programs and open enrollment. These enhancements were developed in response to a 125% increase in demand for health insurance referrals year-over-year from consumers through SpringFour products.

How we help organizations regain a sense of stability after hurricanes and other natural disasters

After Hurricane Sandy in 2012, our expert Resource Integrity Team responded by monitoring, adding, and updating recovery resources — and we’re still at it today.

Organizations should be ready to help with short-term relief and long-term recovery efforts in response to Hurricane Helene, Hurricane Milton, and other natural disasters. SpringFour empowers organizations to help people by:

- Planning to support consumers who will need resources for managing repairs, income, expenses, and debt

- Creating disaster relief landing pages and comprehensive evergreen support centers

- Prioritizing long-term recovery in tandem with short-term relief efforts

- Elevating vulnerable communities and increasing their access to financial health resources

- Connecting people with vetted financial health resources that are up-to-date, accurate, and helpful

We continuously monitor for new, relevant, trusted nonprofit and government natural disaster recovery resources that support consumers.

Delivering homeowners much-needed assistance as HAF shutters

As the American Rescue Plan’s Homeowner Assistance Fund (HAF) programs have been coming to an end, we’re connecting homeowners with non-profit, government, and other mortgage relief resources in more than 700 locations nationwide.

Many of these are aimed at preventing foreclosure and helping homeowners stay afloat as:

SpringFour provided almost half a million referrals to HAF programs during the pandemic. In response to the closure of HAF, we’ve expanded our mortgage relief resources to include more than 300 non-profit, government, and other programs (outside of the HAF programs) for homeowners having difficulty making their mortgage payments and facing foreclosure.

Whatever your organization’s needs are to support consumers, now is the time to leverage a partnership with SpringFour to drive financial health and business impact! Email impact@springfour.com to learn how you can begin using SpringFour in three weeks or less.

Morgan Pierce

Impact & Communications Manager, SpringFour

Awards and Recognition

DRIVE IMPACT WITH US

FOLLOW US

JOIN OUR MAILING LIST

Fay Servicing’s Partnership with SpringFour Helping Thousands of Struggling Borrowers

SpringFour’s Added Health Insurance Resources Ease Open Enrollment Puzzle

SpringFour’s Added Health Insurance Resources Ease Open Enrollment Puzzle

The financial wellness fintech’s increased health insurance resources deliver critical assistance to Americans during the open enrollment period, starting Nov. 1.

CHICAGO, October 30, 2024 – SpringFour, the first-of-its-kind, leading financial health fintech, today announced the expansion of its health insurance resources, at a pivotal time when many Americans are weighing their insurance options. By expanding its solutions to include nonprofit local Health Insurance Navigators, SpringFour offers a lifeline to the uninsured during the crucial open enrollment period starting November 1.

Healthcare costs are burdensome for half of American adults. For seven percent of Americans, the price of insurance alone is so prohibitive that they live uninsured and skip routine healthcare visits, despite the risk of facing hefty medical bills. Millions of people who were enrolled in Medicaid during the pandemic have now lost access to that coverage due to ineligibility and need to apply for insurance coverage on the Affordable Care Marketplace. To address these challenges, SpringFour’s expanded health insurance resources will ease the strain on people worried about how they’ll pay for unexpected or routine medical care.

Building on SpringFour’s existing resources of government-backed insurance assistance, it has now added non-profit Health Insurance Navigators that help individuals with insurance program research and enrollment. By widening its reach in health insurance, SpringFour now offers access to hundreds of vetted local and state programs dedicated to closing the uninsured gap. In response to a 125% increase in demand from consumers for SpringFour’s health insurance referrals year-over-year, SpringFour added to its health insurance resources and authored a brand new Financial Health Resource Guide on Health Insurance which provides information on navigating government programs and open enrollment as well as obtaining Health Insurance through the Health Insurance Marketplace, including health insurance options and a link to the exchange for each state health insurance marketplace.

Giving people access to the support they need to pay for necessities such as healthcare and housing improves their overall financial health. This is at the heart of why Rochelle Nawrocki Gorey founded SpringFour in 2005.

“People shouldn’t have to worry about how they’re going to pay for their insurance or medical bills — but healthcare costs have become a much greater piece of the household budget. By expanding SpringFour’s health insurance resources we’re giving people more options to reduce their costs and improve their financial standing. We’re proud to deliver these resources in partnership with leading organizations, and connecting people who are struggling financially with vetted nonprofit organizations now, during open enrollment, has the greatest impact,” said Nawrocki Gorey.

Since its launch in 2005, SpringFour has connected millions of Americans to resources that improve their financial health. In the second quarter of 2024, SpringFour delivered more than 2 million financial health referrals to consumers in need, 13% more than the previous quarter and more in one quarter than ever before.

Learn more about SpringFour here: https://springfour.com/

About SpringFour

Founded in 2005, SpringFour is the first-of-its-kind, leading social impact fintech that empowers banks, credit unions, fintech lenders, employers, loan servicers, mortgage insurers, nonprofits, and organizations across all industries to connect consumers with vetted, local nonprofit and government financial health resources. Trusted by leading organizations including Capital One, BMO, Fifth Third Bank, MSUFCU, M&T Bank, OppFi, KeyBank, Patelco Credit Union, Avant, Enova, Oportun, Mission Lane, and more, SpringFour’s product suite includes an innovative contact center tool, digital self-service products, and APIs that increase payment performance, add brand value, strengthen customer relationships, drive ESG and social impact, support consumer financial health, and improve bottom lines. SpringFour has received many prestigious awards including American Banker’s Most Influential Women in Fintech, Inc. Magazine’s Female Founders 250, Real Leaders’ Top Impact Companies, Fast Company’s Brands that Matter, Finovate’s Innovator of the Year, and more. SpringFour was recently acquired by C&R Software, a CORA Group company and subsidiary of Constellation Software, Inc., the 23rd largest software company in the world with an $80B market cap.

Awards and Recognition

Recent Comments