Mission-driven fintechs OppFi and SpringFour partner to empower customers

Mission-driven fintechs OppFi and SpringFour partner to empower customers

This month, OppFi announced its critical work with SpringFour to financially empower customers in a fantastic press release. Together with OppFi, SpringFour is providing access to more than 22,000 financial resources that support borrowers in need.

We like to see when our partners share the impact they deliver with SpringFour with their networks. Our joint work to bring focus to financial health strategies that improve businesses, inspire other organizations in the industry, and change consumers’ lives is both timely and effective.

The announcement was also covered in IBS Intelligence and PYMNTS.

We are proud to partner with OppFi, a like-minded, mission-driven fintech. To learn more about opportunities for sharing and promoting your organization’s partnership with SpringFour, contact us at impact@springfour.com.

Morgan Pierce

Morgan Pierce

Impact and Communications Manager

Awards and Recognition

DRIVE IMPACT WITH US

FOLLOW US

JOIN OUR MAILING LIST

OppFi’s lending platform OppLoans launches same-day funding service

2022 Annual Impact Report: Empowering organizations to improve consumers’ financial health

2022 Annual Impact Report: Empowering organizations to improve consumers’ financial health

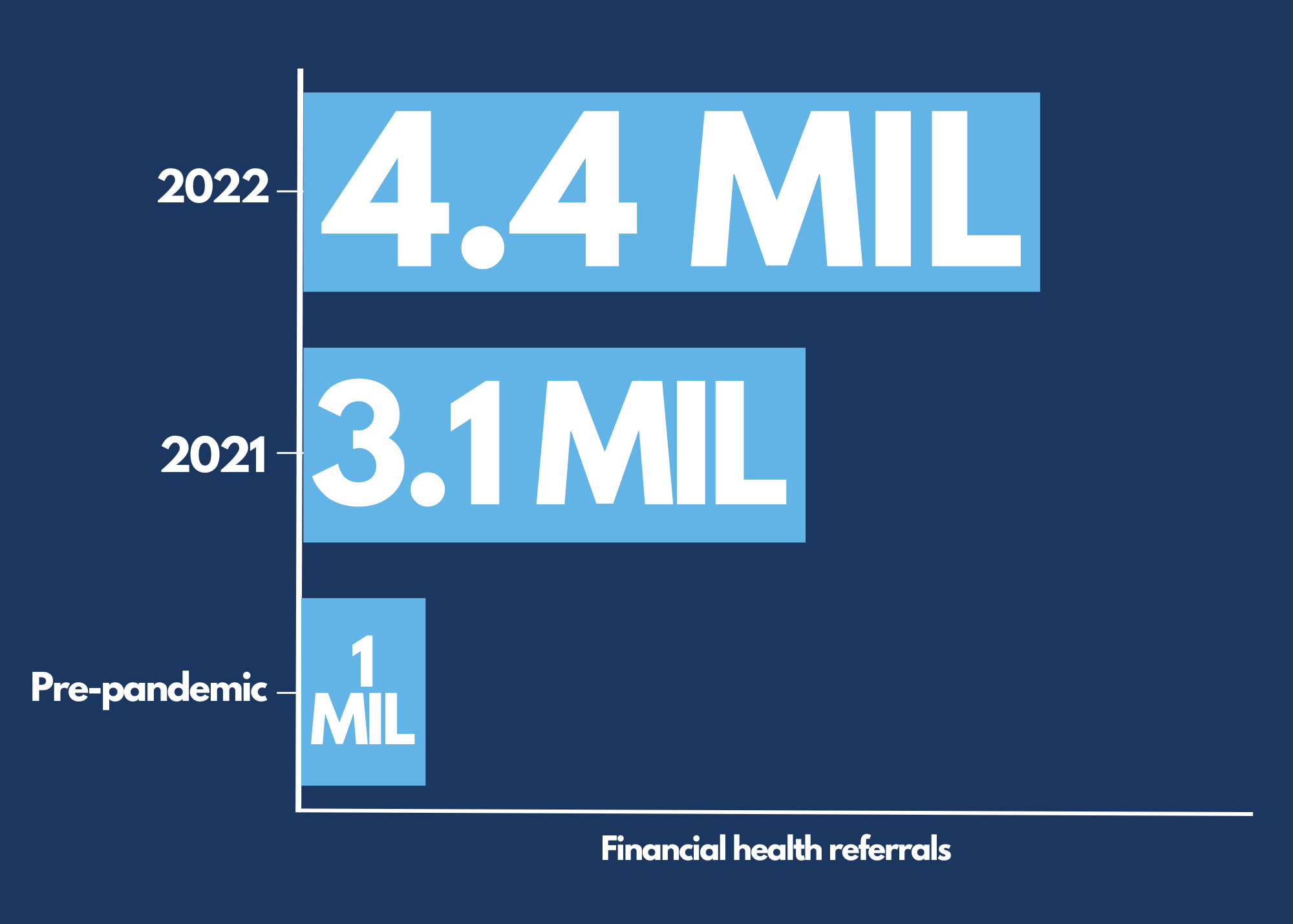

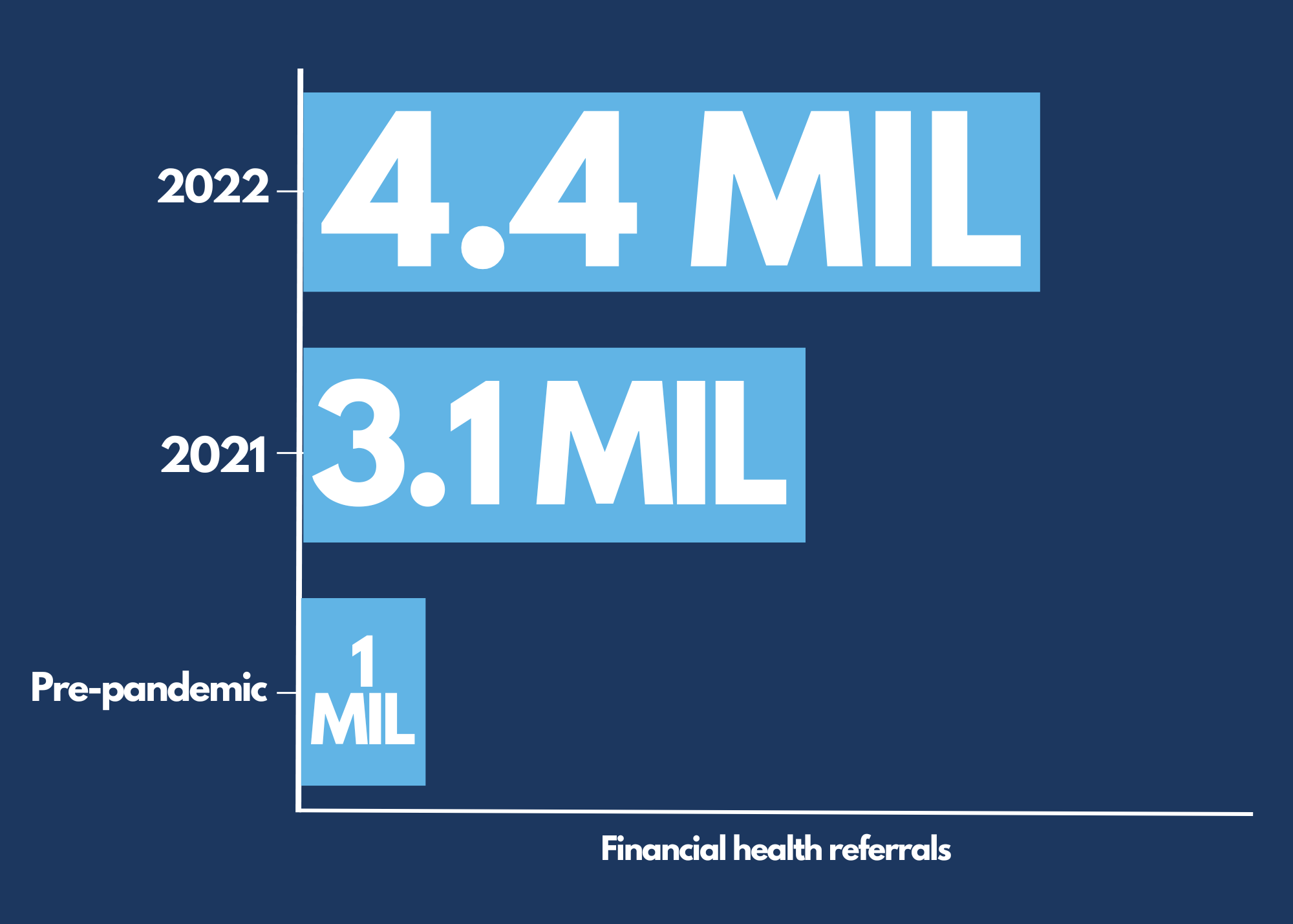

SpringFour is proud to deliver our 2022 Annual Impact Report summarizing our accomplishments and impact throughout 2022. We partnered with major banks, credit unions, auto and fintech lenders, consumer finance lenders, employee relief providers, nonprofit organizations, and more to deliver over 4.4 million referrals to consumers across the country. In 2020 and 2021, we reached just over 3 million referrals each year, and delivered just 1 million referrals per year before the pandemic.

At SpringFour, we believe people deserve connection to financial health resources they may want or need. We understand that addressing the root causes of financial hardship by empowering people with resources creates a win-win-win: improving consumer financial health; customer, borrower, and employee retention rates; and business impacts and ROI.

Behind every referral is a consumer experiencing financial hardship. We are committed to changing the way our industry responds to people experiencing financial hardship with the goal of eliminating stigma, providing valuable support, and treating people with empathy, dignity, and respect.

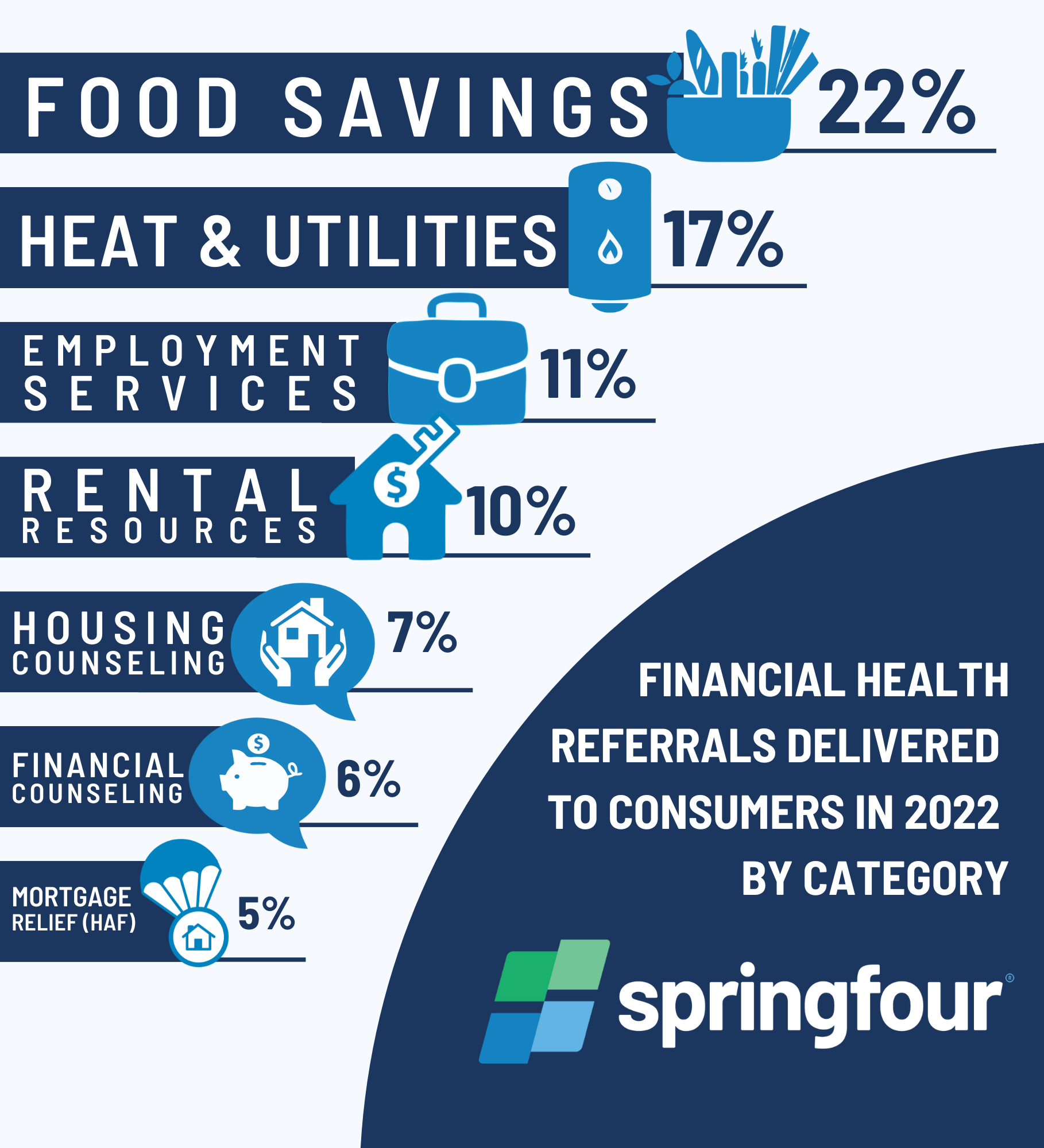

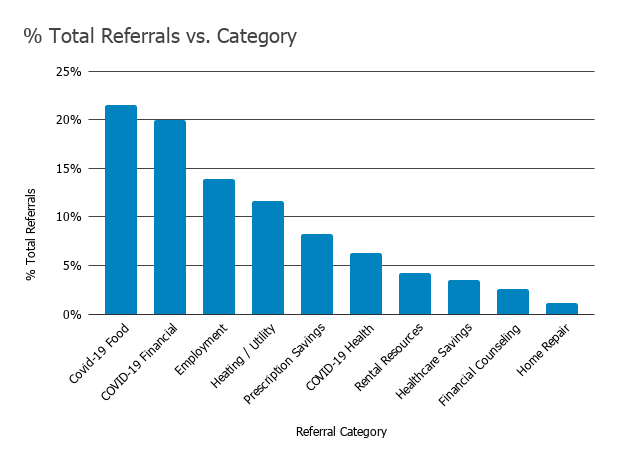

Consumers requested and received access to the following resources in 2022:

Thanks for joining us this year as we work diligently with our partners to connect as many consumers as possible with financial health resources they want, need, and deserve.

“We have seen a tremendous benefit to our customers. Since the beginning of our partnership, SpringFour has provided BMO customers with references to over 200,000 crucial financial health resources. This has been a valuable experience that we are proud to offer our customers, and which has also benefited the bank through improved portfolio performance.”

– Jeoff Begin, Vice President, Head of US Collections & North American Small Business Special Accounts, BMO Harris Bank

Morgan Pierce

Morgan Pierce

Impact and Communications Manager

Awards and Recognition

DRIVE IMPACT WITH US

FOLLOW US

JOIN OUR MAILING LIST

Recent Comments