Delinquency rates could get worse. Here’s a win-win solution

Delinquency rates could get worse. Here’s a win-win solution

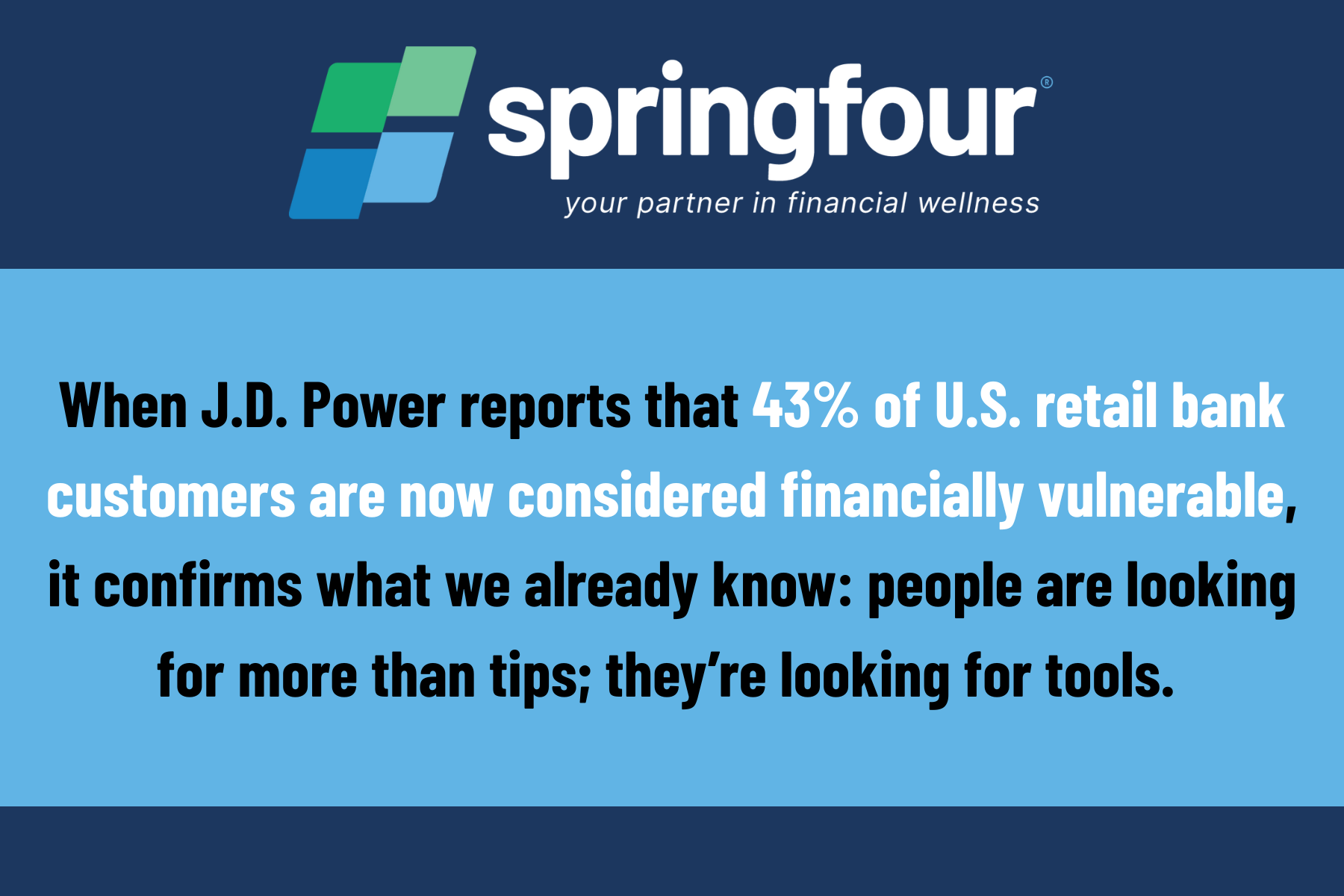

These delinquencies aren’t just bad for consumers — they’re a serious pain point for financial institutions.

Have you considered how your organization will manage this challenging landscape amid rising delinquencies?

It’s possible to avoid the internal panic and executive-level pressure to act that comes with these noticeable spikes in delinquencies with SpringFour.

With SpringFour, organizations:

☑️ Build customer loyalty

☑️ Improve portfolio performance

☑️ Drive increased repayment rates

How SpringFour Helps Prevent Delinquency

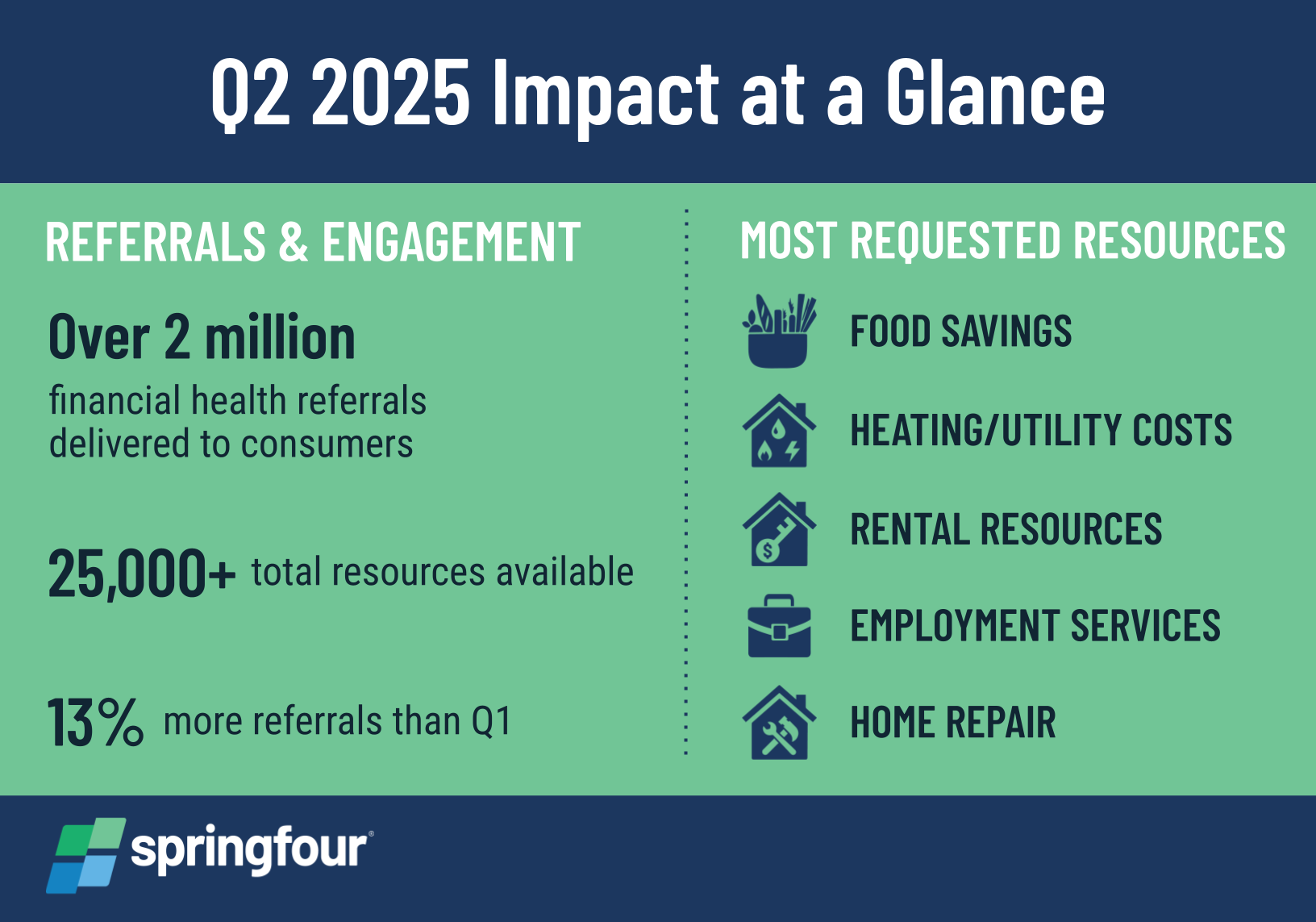

Timely Help, Tangible Impact: Seasonal Campaigns That Deliver

For Life’s Toughest Moments: Help Customers Navigate Hardship with Actionable Financial Health Resources

From Advice to Outcome: Financial Health Resources That Go Beyond Education

Drive Real Change: Build Stronger Communities with Trusted Financial Health Resources

Help That Prevents Hardship: Keep Customers on Track with Proactive Financial Health Resources

Start driving impact for your customers, employees –– and your bottom line. Email us at impact@springfour.com.

TESTIMONIAL

“SpringFour offers one set solution that’s a no-brainer… And if we’re genuinely interested in helping [our customers] make that financial progress, what I call real financial progress, we have to think outside the box. We have to look for new solutions. We have to think ‘What else is out there that we can use to help our clients?’ But it has to start with a mindset that has to change where we’re not in the business of collecting money, we’re in the business of offering solutions.”

– Anuj Vohra, Head of North America Collections, BMO

Awards and Recognition

Recent Comments