Achieve measurable impact with our award-winning financial health solutions

Achieve measurable impact with our award-winning financial health solutions

SpringFour’s solutions have fed families, kept people in their homes, reduced prescription costs, found people jobs, secured child care, & so much more

Increase Repayment Rates

![]() 2-10x increase in repayment rates

2-10x increase in repayment rates

![]() $1,000 reduction, on average, in annual net credit losses per customer

$1,000 reduction, on average, in annual net credit losses per customer

![]() Millions in projected annualized credit loss savings

Millions in projected annualized credit loss savings

Add Brand Value

![]() 7 percentage point increase in Net Promoter Scores (NPS)

7 percentage point increase in Net Promoter Scores (NPS)

![]() 95% of agents agree that SpringFour helps their organization build trust with customers

95% of agents agree that SpringFour helps their organization build trust with customers

Drive Financial Success

![]() Over 5x ROI in one year

Over 5x ROI in one year

![]() Customers are 2X more likely to engage in foreclosure prevention and payment programs after receiving SpringFour referrals

Customers are 2X more likely to engage in foreclosure prevention and payment programs after receiving SpringFour referrals

Reduce Expenses

![]() 96% of agents agree that SpringFour helps their consumers save money, reduce expenses, get back on track with payments, or improve financial health

96% of agents agree that SpringFour helps their consumers save money, reduce expenses, get back on track with payments, or improve financial health

Empower Employees

![]() 93% of agents agree they do a better job when they have access to SpringFour

93% of agents agree they do a better job when they have access to SpringFour

![]() 98% of agents agree SpringFour increases empathy within their organization

98% of agents agree SpringFour increases empathy within their organization

Improve Customer Service

![]() 96% of agents agree that they provide better customer service when they have access to SpringFour

96% of agents agree that they provide better customer service when they have access to SpringFour

![]() 91% of agents agree SpringFour saves them time when working with a client

91% of agents agree SpringFour saves them time when working with a client

CEO & Founder Rochelle Gorey shares SpringFour’s mission to remove stigma & drive win-win solutions for people experiencing financial challenges

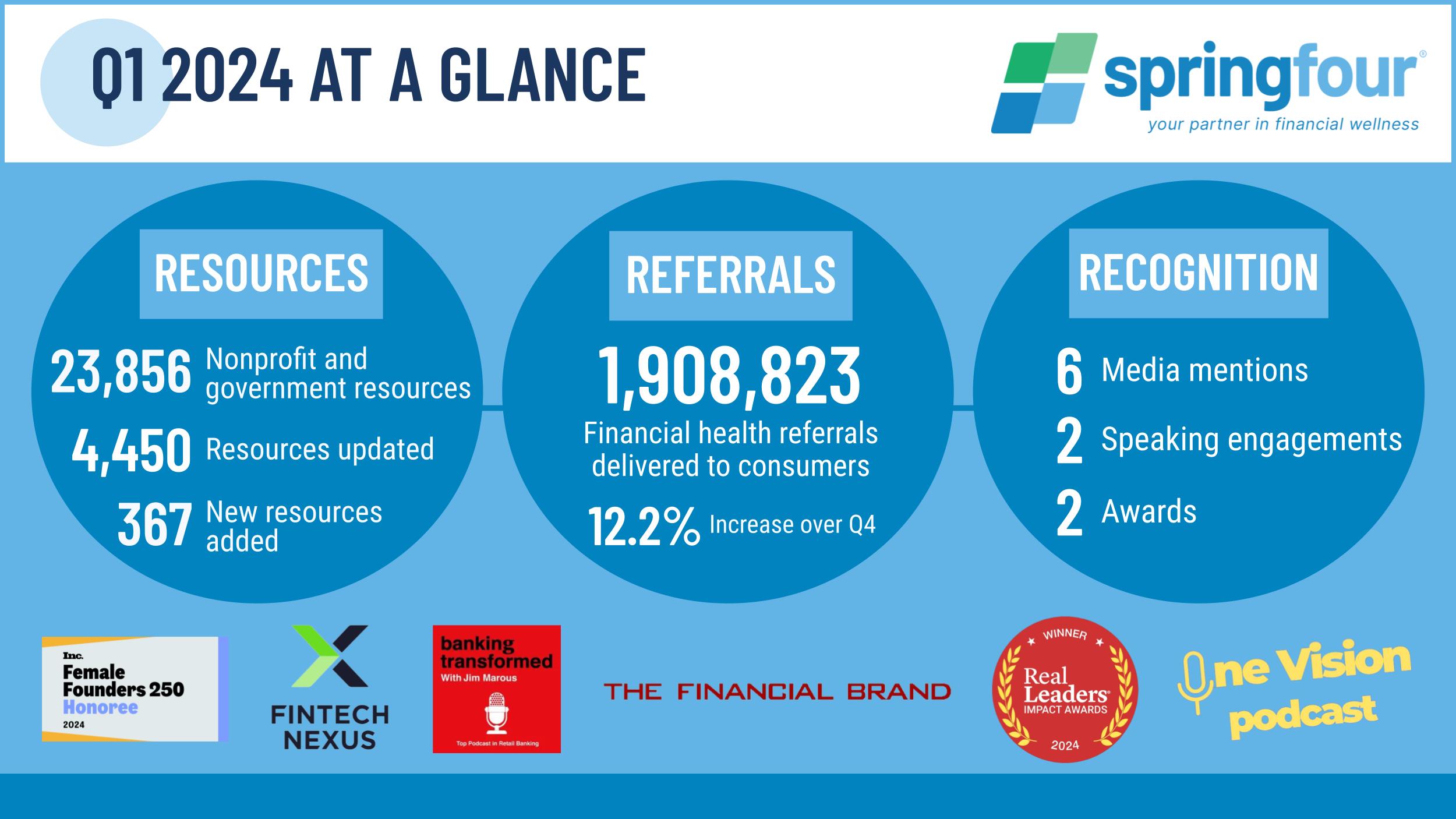

Explore SpringFour’s Quarterly and Annual Impact Reports

Case Studies

Explore our detailed studies demonstrating how our clients leverage the power of SpringFour to deliver results.

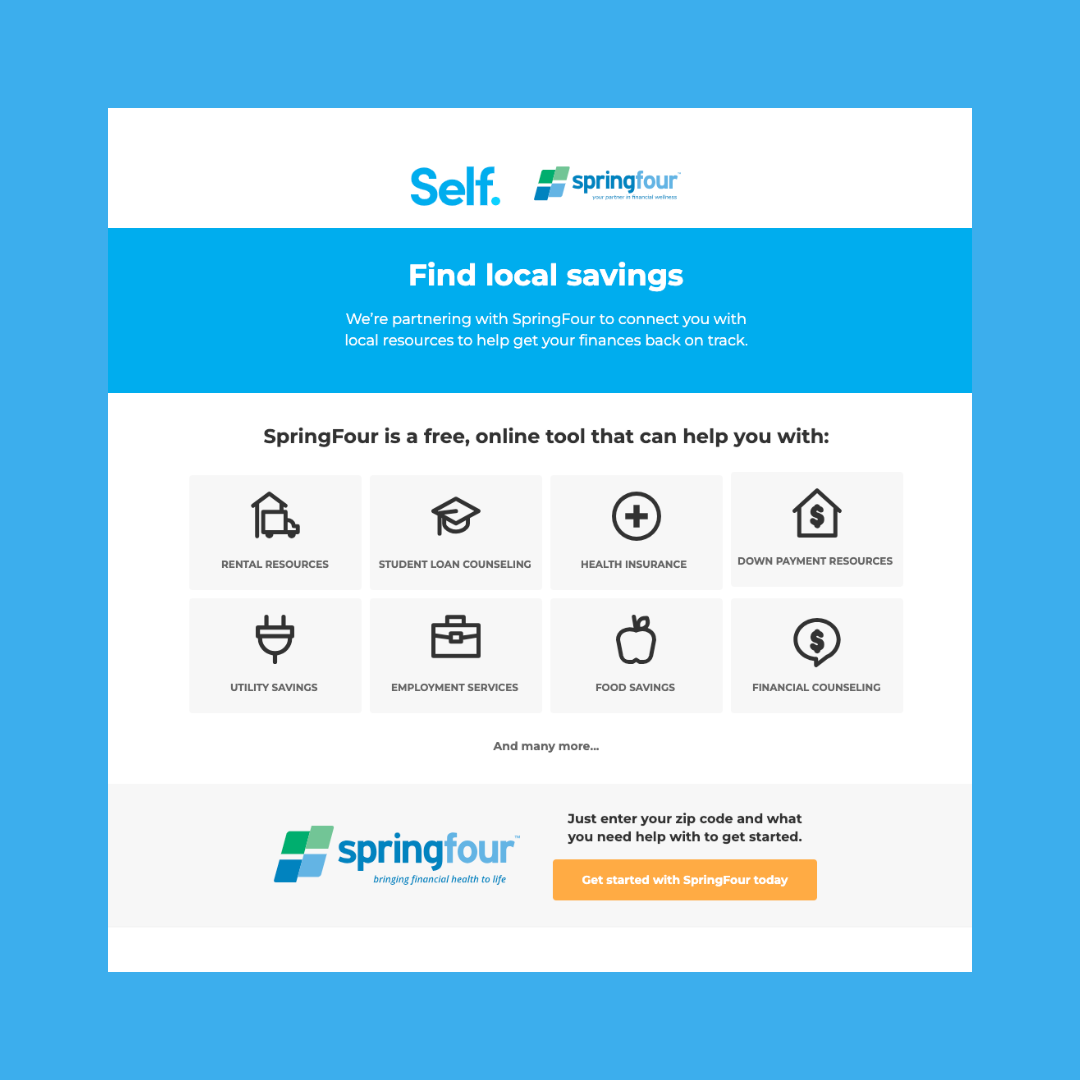

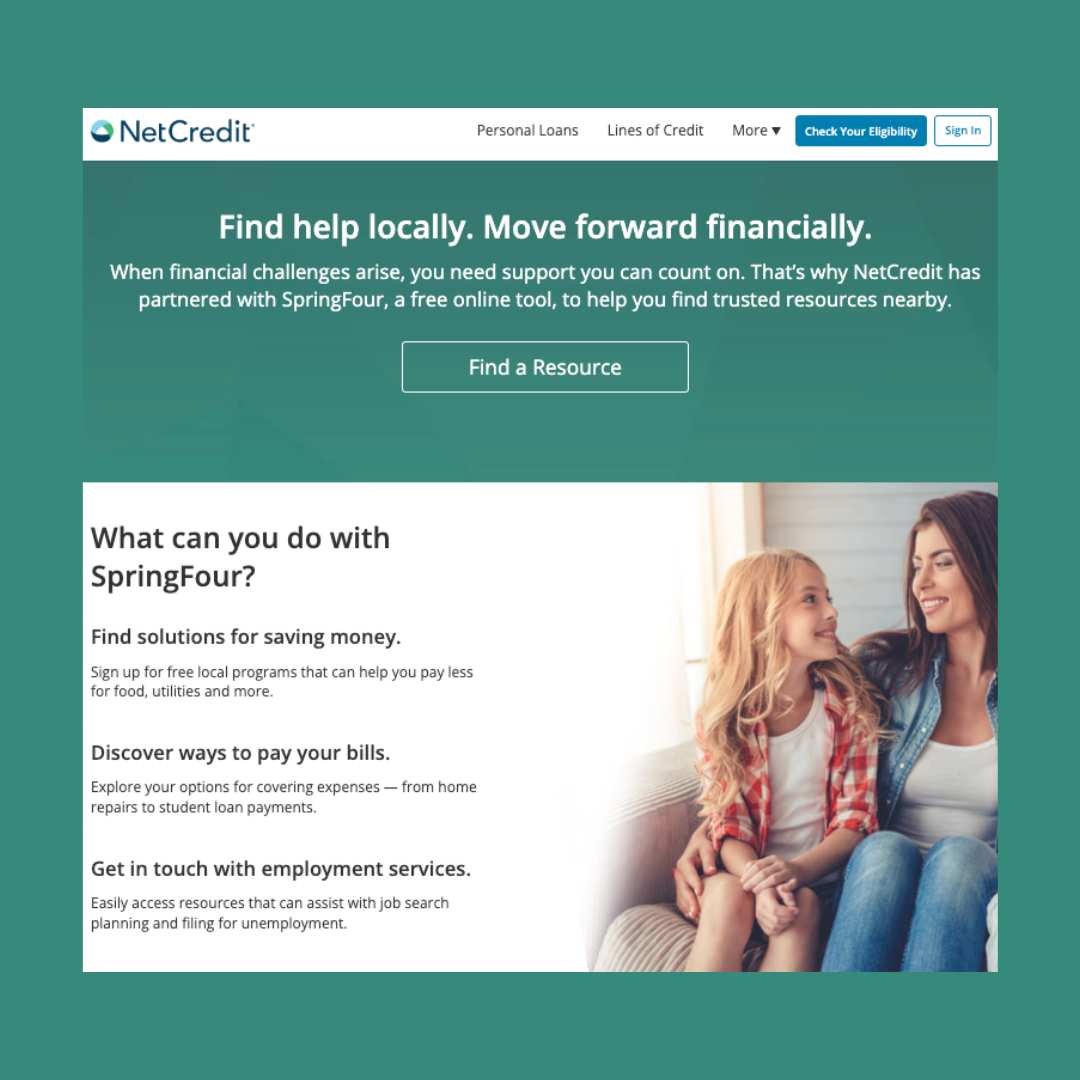

How a Credit Builder and a Fintech Support Financial Health

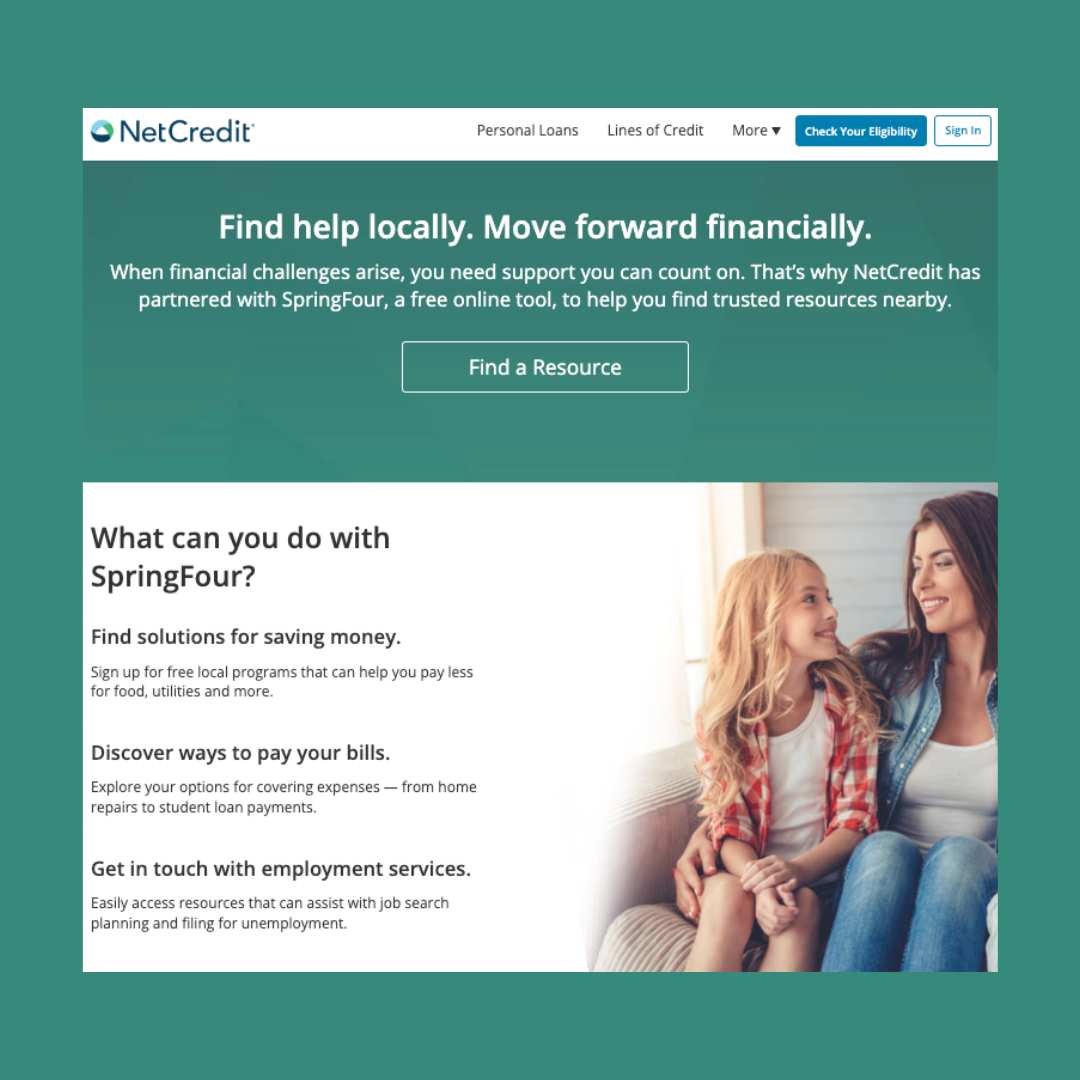

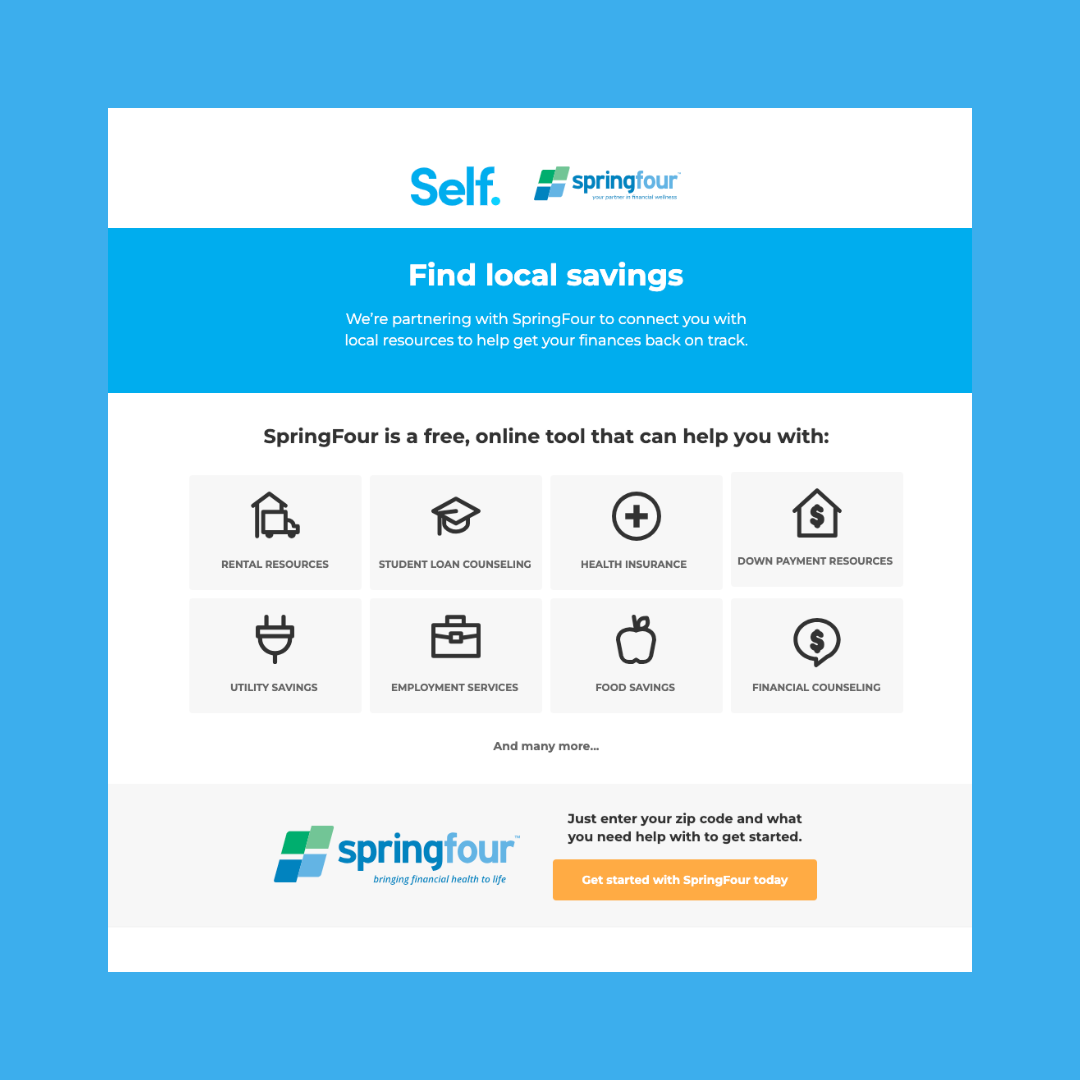

Since 2019, Self, a credit-building platform that increases economic inclusion and financial resilience, has worked with SpringFour, the financial health fintech that helps companies connect customers to financial resources.

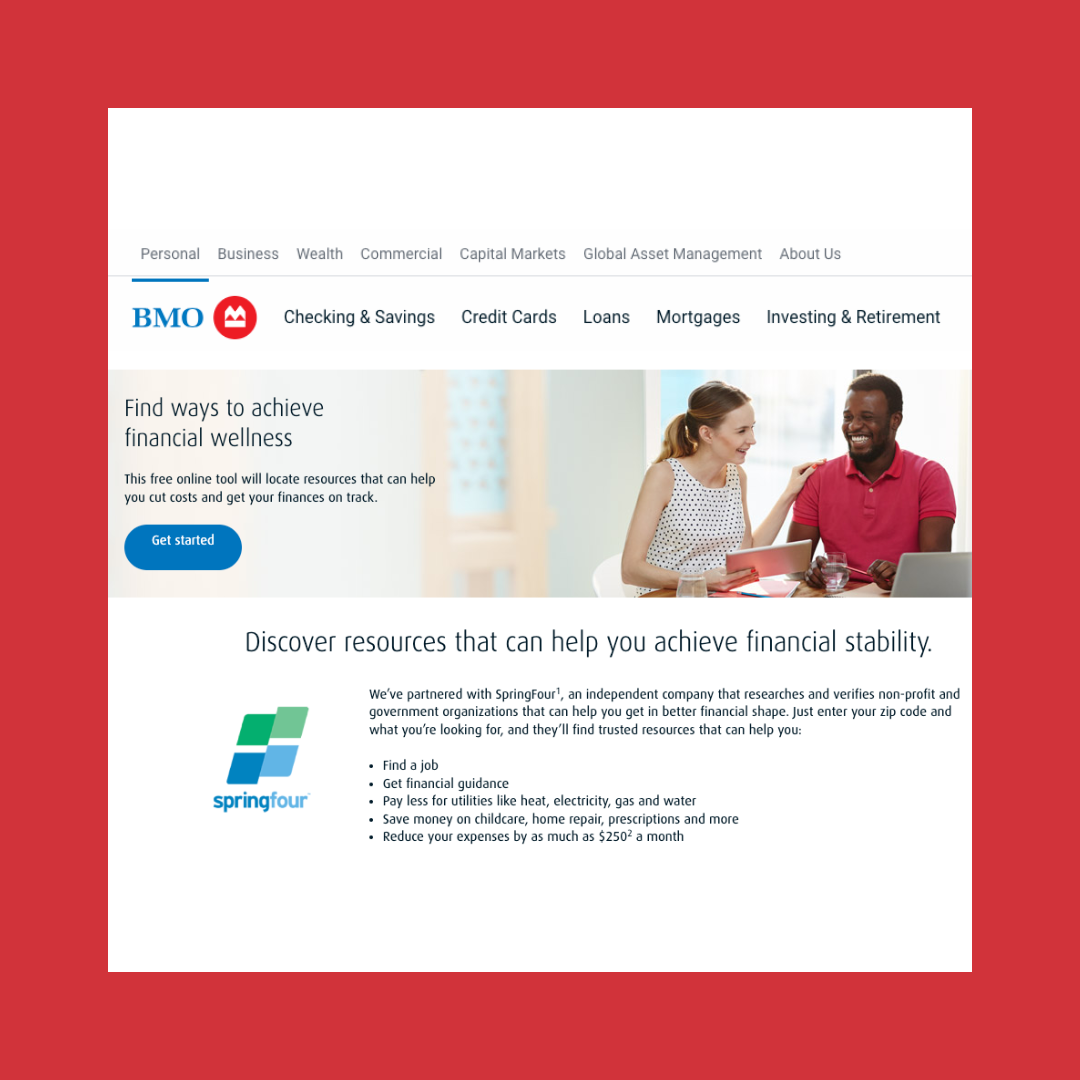

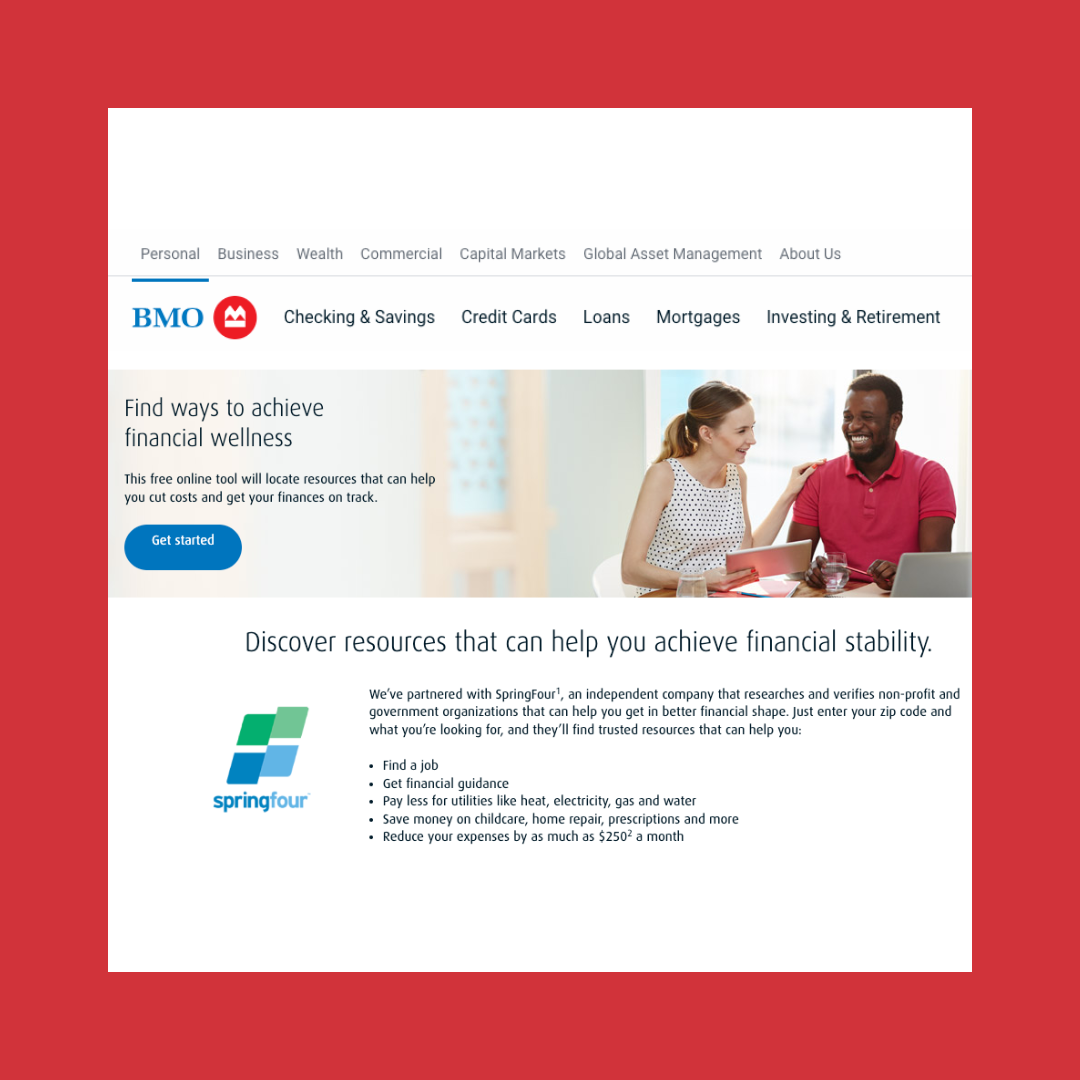

BMO and SpringFour Drive Better Portfolio Performance

Since 2018, SpringFour has been an integral element of banking and financial services giant BMO’s efforts to provide financial wellness solutions to its customers and help them make real financial progress.

SpringFour is Integral to ESG: Financial Health is Social Impact

Connecting the dots between financial health & ESG is highly impactful on the financial services industry. Partnerships are integral to the impact story our clients tell stakeholders about this critical work.

Where Employers are Taking Financial Health

Three leaders from SpringFour & Canary — with more than 75 years of combined experience in helping people access the resources, products, & services they need — discuss financial health & employer-fintech collaborations.

How a Credit Builder and a Fintech Support Financial Health

Since 2019, Self, a credit-building platform that increases economic inclusion & financial resilience, has worked with SpringFour, the financial health fintech that helps companies connect customers to financial resources.

BMO and SpringFour Drive Better Portfolio Performance

Since 2018, SpringFour has been an integral element of banking and financial services giant BMO’s efforts to provide financial wellness solutions to its customers and help them make real financial progress.

SpringFour is Integral to ESG: Financial Health is Social Impact

Connecting the dots between financial health & ESG is highly impactful on the financial services industry. Partnerships are integral to the impact story our clients tell stakeholders about this critical work.

Where Employers are Taking Financial Health

Three leaders from SpringFour & Canary — with more than 75 years of combined experience in helping people access the resources, products, & services they need — discuss financial health & employer-fintech collaborations.

Overcoming Housing Insecurity One Family at a Time

MMI & SpringFour share a kindred mission in supporting families through financial challenges. Together they helped renters maintain housing security through the Covid crisis.

A Chicago Fintech Financial Health Collaboration

Enova & SpringFour work together to improve families’ financial health. Read the case study to see how this partnership helped customers through the Covid crisis & beyond.

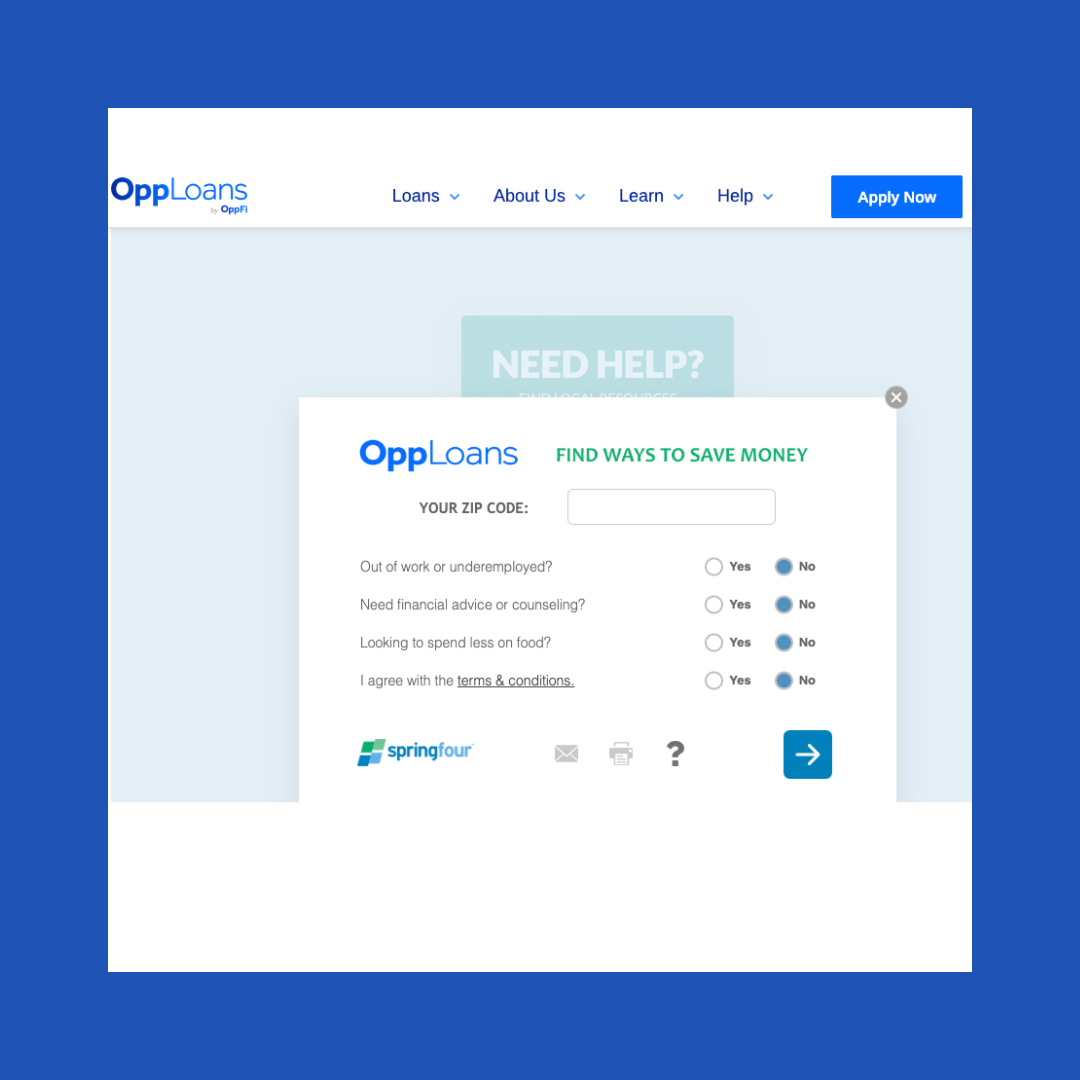

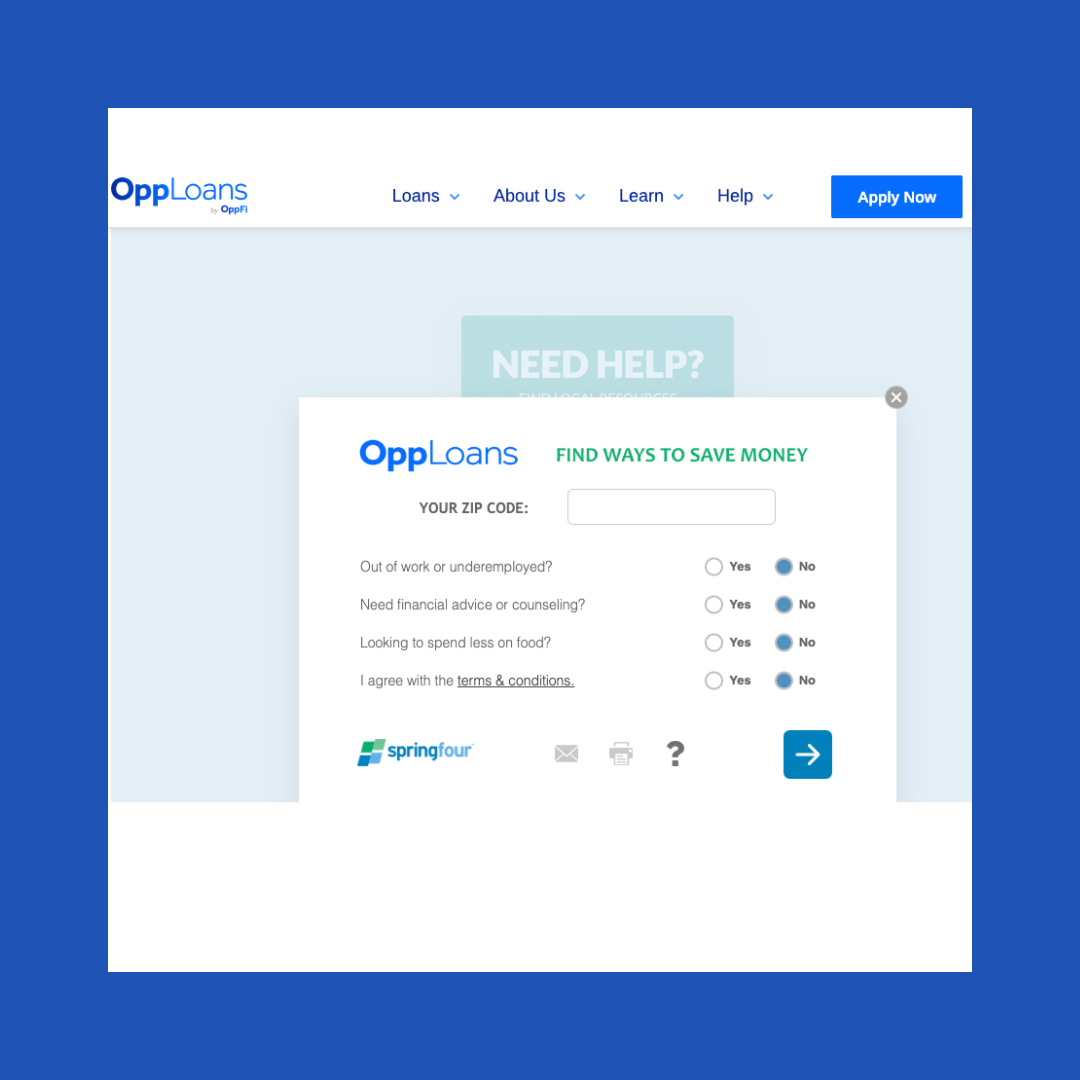

Partnering Through a Pandemic

OppFi & SpringFour are mission-aligned companies creating unique solutions that improve consumers’ financial lives. When Covid hit, the companies quickly banded together to help families in critical need of resources.

Building Credit by Building Partnerships

SpringFour & Self work together with a mutually-held belief: Credit & savings are necessary, but not sufficient, for lower-income families to build financial health. They also need empowerment, product choice, & more.

Overcoming Housing Insecurity One Family at a Time

MMI & SpringFour share a kindred mission in supporting families through financial challenges. Together they helped renters maintain housing security through the Covid crisis.

A Chicago Fintech Financial Health Collaboration

Enova & SpringFour work together to improve families’ financial health. Read the case study to see how this partnership helped customers through the Covid crisis & beyond.

Partnering Through a Pandemic

OppFi & SpringFour are mission-aligned companies creating unique solutions that improve consumers’ financial lives. When Covid hit, the companies quickly banded together to help families in critical need of resources.

Building Credit by Building Partnerships

SpringFour & Self work together with a mutually-held belief: Credit & savings are necessary, but not sufficient, for lower-income families to build financial health. They also need empowerment, product choice, & more.

Helping Families Weather Financial Hardship

BMO & SpringFour’s powerful partnership supports people through financial hardship. Together, BMO & SpringFour deliver local resources that can help to BMO customers that can help every day.

Driving Customer Service & Loan Performance

U.S. Bank saw better customer service, foreclosure prevention, & repayment rates from its partnership with SpringFour — showing how delivering resources benefits customers, employees, & bottom lines.

Helping Families Weather Financial Hardship

BMO & SpringFour’s powerful partnership supports people through financial hardship. Together, BMO & SpringFour deliver local resources that can help to BMO customers that can help every day.

Driving Customer Service & Loan Performance

U.S. Bank saw better customer service, foreclosure prevention, & repayment rates from its partnership with SpringFour — showing how delivering resources benefits customers, employees, & bottom lines.

Drive ESG & Social Impact with SpringFour

We work with our clients to measure and demonstrate ESG impact that empowers organizations to reach their goals, support their employees, and make a difference in their customers’ lives. We deliver measurable and reportable social impact metrics that help you get the credit you deserve:

- Number of referrals delivered

- Number of customers served

- Most requested categories of financial need

- Geographic locations where resources were most requested

SpringFour has been cited as an integral ESG partner by

![]()

![]()

![]()

![]()

SpringFour’s Real-Life Impact

See how we connect people to resources that make a difference and empower financial wellness.

Ready to get started?

Deploy in less than 30 days to drive impact for your customers, employees, and organization with SpringFour.

Awards & Recognition