When your customers are financially healthy, everyone wins.

With our financial health referral solutions, you can easily connect your customers to resources that save them money, increase payment rates, and power financial health.

When your customers are financially healthy, everyone wins.

With our financial health referral solutions, you can easily connect your customers to resources that save them money, increase payment rates, and power financial health.

Our Solutions Make an Impact

SpringFour, the woman-led, social impact fintech, delivered over 8.5 million financial health referrals to customers in 2024 in partnership with leading banks, credit unions, fintech lenders, employers, mortgage servicers, nonprofits, and more.

Increase Payment Rates

![]() 2-10x increase in repayment rates

2-10x increase in repayment rates

![]() $1,000 reduction, on average, in annual net credit losses per customer

$1,000 reduction, on average, in annual net credit losses per customer

![]() Millions in projected annualized credit loss savings

Millions in projected annualized credit loss savings

Empower Employees

![]() 96% of agents agree that they provide better customer service when they have access to SpringFour

96% of agents agree that they provide better customer service when they have access to SpringFour

![]() 91% of agents agree that SpringFour saves them time when working with a client

91% of agents agree that SpringFour saves them time when working with a client

Improve Financial Health

![]() Customers are 2x more likely to engage in foreclosure prevention and payment programs after receiving SpringFour referrals

Customers are 2x more likely to engage in foreclosure prevention and payment programs after receiving SpringFour referrals

![]() 96% of agents agree that SpringFour helps their consumers save money, reduce expenses, or get on track with payments

96% of agents agree that SpringFour helps their consumers save money, reduce expenses, or get on track with payments

Demonstrate Empathy

![]() 98% of agents agree that SpringFour increases empathy within their organization

98% of agents agree that SpringFour increases empathy within their organization

![]() 95% of agents agree that SpringFour helps their organization build trust with customers

95% of agents agree that SpringFour helps their organization build trust with customers

Powering Financial Health with Bank-Fintech Partnerships

Head of Deposit Products at BMO, Ben Schack, discusses the power of partnership with SpringFour

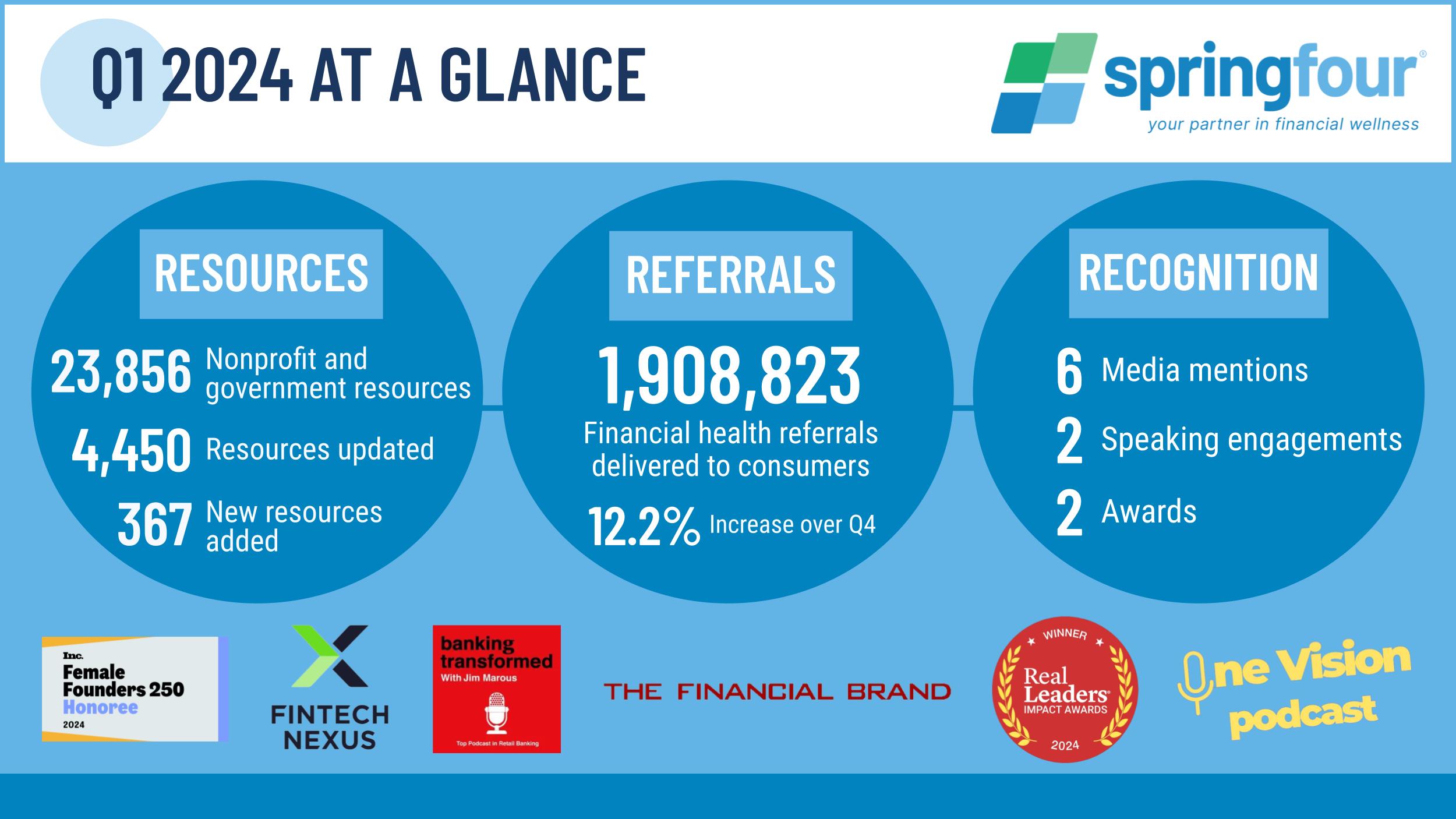

Explore SpringFour’s Quarterly and Annual Impact Reports

You’re in Good Company

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

You’re in Good Company

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

Testimonials

Ready to see results?

Deploy in 30 days or less to drive impact with SpringFour.

Awards & Recognition

ANUJ VOHRA

ANUJ VOHRA

BILL IVERSON

BILL IVERSON  EZRA GARRETT

EZRA GARRETT  THEODORA LAU

THEODORA LAU

DEEPTI GUPTA

DEEPTI GUPTA  PETER RENTON

PETER RENTON  RICO DELGADILLO

RICO DELGADILLO

JIM TRIGGS

JIM TRIGGS

DEEPTI GUPTA

DEEPTI GUPTA JIM TRIGGS

JIM TRIGGS